SFA BASICS

Competitors' Analysis for CPG brands:

What In-store Intelligence Can Tell You

What In-store Intelligence Can Tell You

Competitor analysis is crucial for brands and retailers to perform well in the market. However, conducting accurate and up-to-date research may not be easy. Fortunately, there are tools available to help gather the needed data and improve performance.

What is competitive analysis

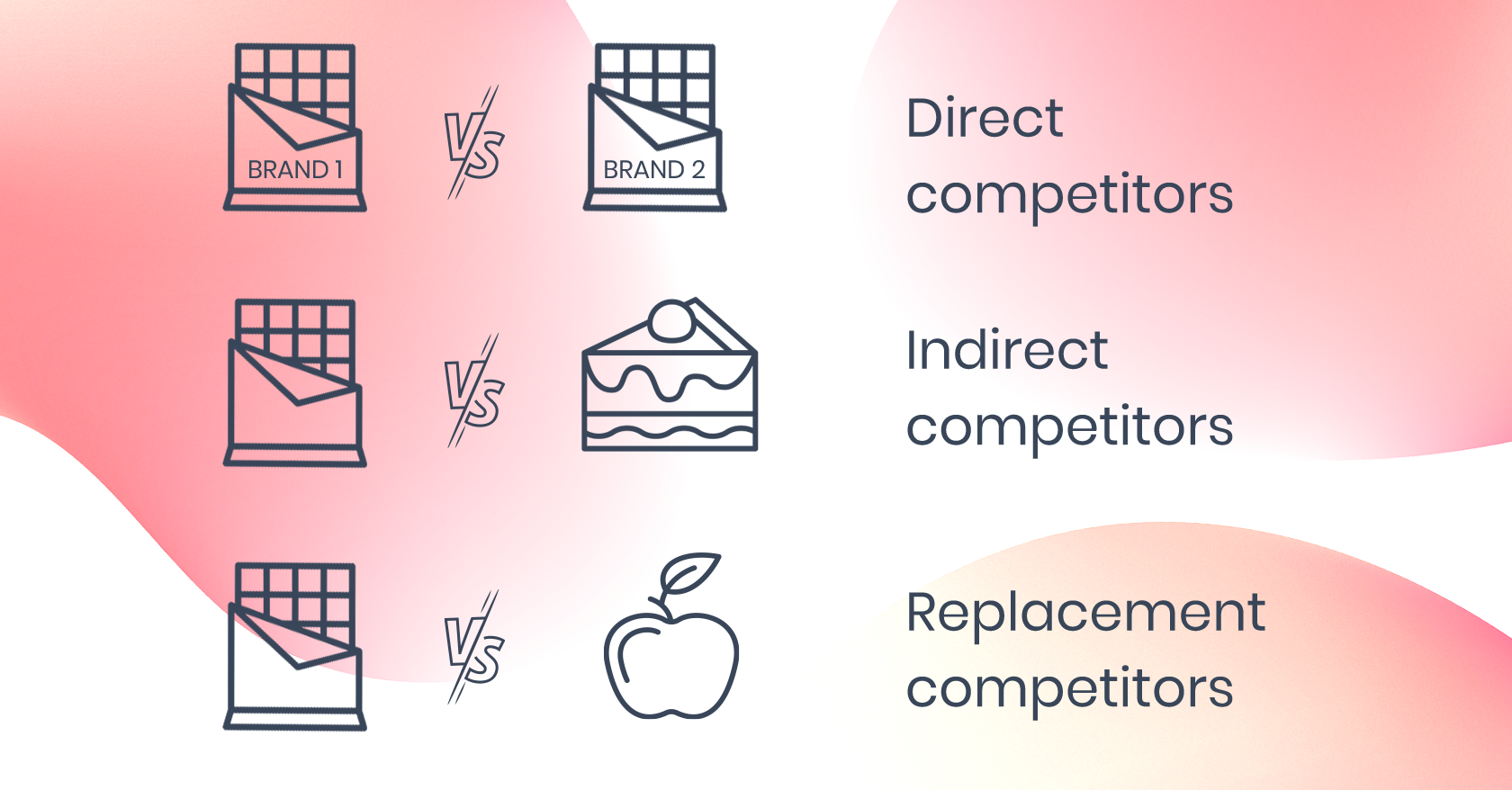

Competitive analysis or competitor research involves gathering information about other brands and products in the market. There are three types of competitors: direct, indirect, and replacement.

Direct competitors are brands and products that share similar features and target the same audience. For example, Mars chocolate's direct competitors include Snickers and other chocolate bars.

Indirect competitors solve the same audience problem but have different features, and fall in the same category as the offer. Mars' indirect competitors are cookies or musli bars: their purpose is to provide a snack in a short period of time.

Replacement competitors solve the same problem but use different means. For instance, when choosing a sweet snack, one could opt for either a chocolate Mars bar or a dried mango. Or for example you're hungry and want a snack: in this situation Mars would compete against not only other snacks but also against lunch in a cafe.

Direct competitors are brands and products that share similar features and target the same audience. For example, Mars chocolate's direct competitors include Snickers and other chocolate bars.

Indirect competitors solve the same audience problem but have different features, and fall in the same category as the offer. Mars' indirect competitors are cookies or musli bars: their purpose is to provide a snack in a short period of time.

Replacement competitors solve the same problem but use different means. For instance, when choosing a sweet snack, one could opt for either a chocolate Mars bar or a dried mango. Or for example you're hungry and want a snack: in this situation Mars would compete against not only other snacks but also against lunch in a cafe.

Knowing all three types of competitors allows brands to create an outstanding marketing strategy that caters to customers' needs and stays unique and recognizable.

Why do you need competitors' analysis

Competitors intelligence is not just for comparing the prices, it's actually a powerful tool which can get you insights about your own products, strategy and marketing overall.

Find your gap

Competitors' research allows you to gain insight on your whole category by main indicators: pricing, assortment, positioning. Thorough analysis will show you the current situation in the market — where the offer is overdue and where the customer needs aren't completely covered. It might help you to find your niche and fill it with a product that is really needed.

Set your Unique Selling Proposition

What's so unique about your product? It's impossible to say if you don't know what you are competing against. Knowing your competitors, their strengths and weaknesses makes you learn more about your product and how you can fight them for your customers' attention.

Trendwatch

Brand managers and marketing specialists are always on a lookout for some new ways to attract, engage and keep the customers. Be sure: if there is some new trend coming in your category those with bigger teams and larger budgets are probably already testing it so it's important to watch what your fellow colleagues are doing.

Save the budget

Watching your competitors and their strategy apart from learning the trends and what works it can also gain you insight into what are do-nots in the category. This helps especially when launching a new product or a whole line of products: if somebody else has already done this and it wasn't a success you should probably rethink your strategy.

Launch a new product

If you are looking at penetrating a new market, doing a competitor analysis is essential. It provides a wealth of key data as to how crowded the market is, the market size and potential for profit or loss. Ultimately saving you time and money.

Benchmark

Competitors analysis lets you compare your performance against those who are considered the best in your categories. The point is to identify what you should aspire to achieve but also find inspiration in their processes and strategy to implement changes and improve yours.

Competitors' research allows you to gain insight on your whole category by main indicators: pricing, assortment, positioning. Thorough analysis will show you the current situation in the market — where the offer is overdue and where the customer needs aren't completely covered. It might help you to find your niche and fill it with a product that is really needed.

Set your Unique Selling Proposition

What's so unique about your product? It's impossible to say if you don't know what you are competing against. Knowing your competitors, their strengths and weaknesses makes you learn more about your product and how you can fight them for your customers' attention.

Trendwatch

Brand managers and marketing specialists are always on a lookout for some new ways to attract, engage and keep the customers. Be sure: if there is some new trend coming in your category those with bigger teams and larger budgets are probably already testing it so it's important to watch what your fellow colleagues are doing.

Save the budget

Watching your competitors and their strategy apart from learning the trends and what works it can also gain you insight into what are do-nots in the category. This helps especially when launching a new product or a whole line of products: if somebody else has already done this and it wasn't a success you should probably rethink your strategy.

Launch a new product

If you are looking at penetrating a new market, doing a competitor analysis is essential. It provides a wealth of key data as to how crowded the market is, the market size and potential for profit or loss. Ultimately saving you time and money.

Benchmark

Competitors analysis lets you compare your performance against those who are considered the best in your categories. The point is to identify what you should aspire to achieve but also find inspiration in their processes and strategy to implement changes and improve yours.

Data sources for competitors' analysis

Digital and offline data are two crucial types of data that help conduct competitor analysis.

Digital data includes all the information that is available online, such as a competitor's social media presence, e-commerce performance, and website analytics. In addition, digital data can include any other type of online data, such as online reviews or customer feedback.

Offline data, on the other hand, is the information that can be collected in-store. This type of data is especially important for retailers who rely heavily on in-store sales. By analyzing offline data, retailers can gain insight into the physical presentation of their competitors' products, the pricing strategy, and other in-store marketing tactics.

Digital data includes all the information that is available online, such as a competitor's social media presence, e-commerce performance, and website analytics. In addition, digital data can include any other type of online data, such as online reviews or customer feedback.

Offline data, on the other hand, is the information that can be collected in-store. This type of data is especially important for retailers who rely heavily on in-store sales. By analyzing offline data, retailers can gain insight into the physical presentation of their competitors' products, the pricing strategy, and other in-store marketing tactics.

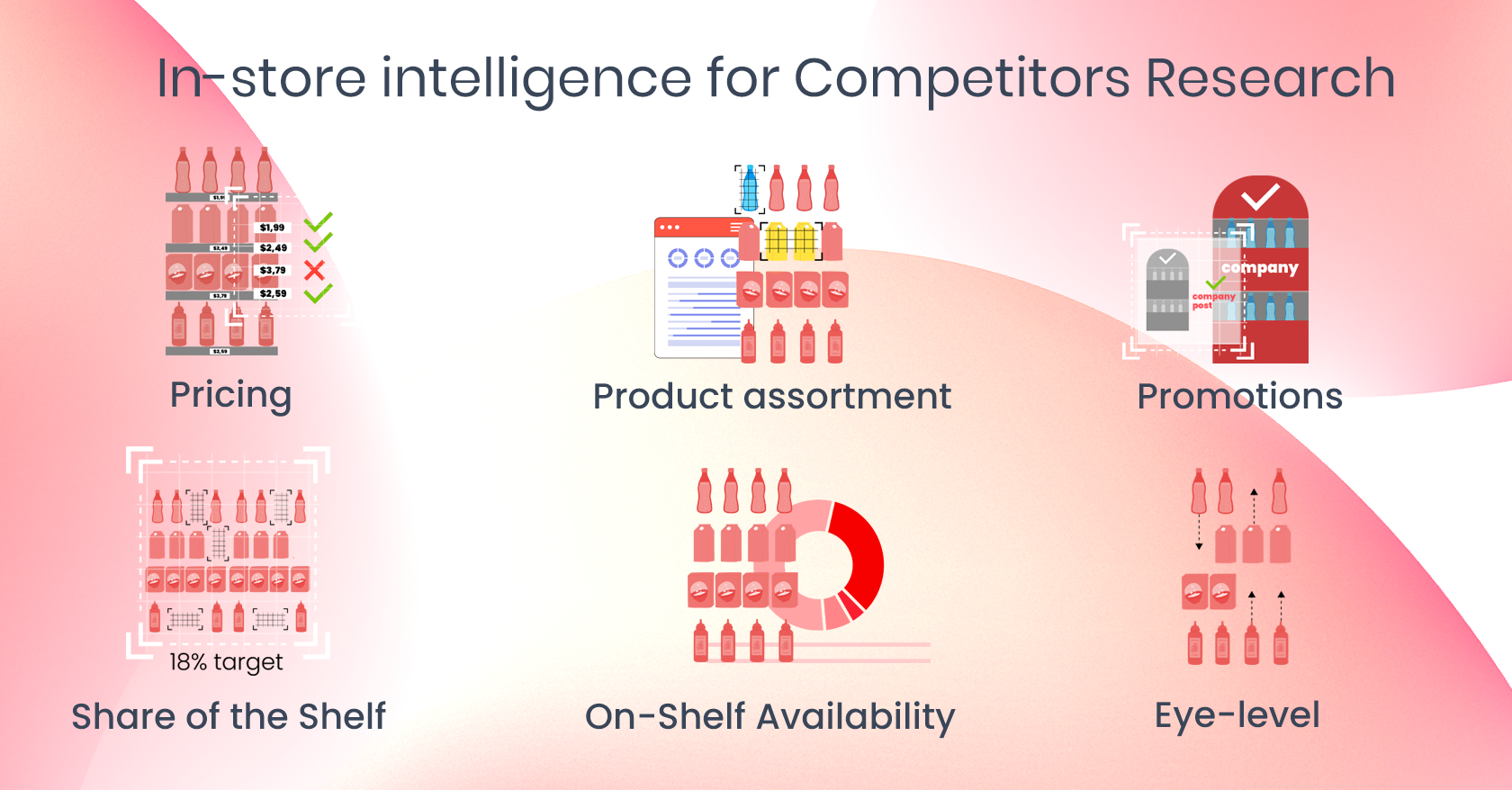

Data collected from the stores

Pricing: In-store data enables you to gain a better understanding of your competitors' pricing policies across various outlets, including retail chains, specialty shops, discounters, and others. Your competitors' prices can serve as a good benchmark for defining your pricing strategy. They can help you determine if your prices are competitive or if you need to adjust them.

Product assortment: This involves observing the variety of products your competitors offer in-store. This information can help you determine if there are gaps in your product offerings that need to be filled or if you need to modify your product line to better meet customer needs.

Promotions: This involves tracking any promotional activity your competitors are engaging in, such as sales, discounts, or bundle deals. It can also help pinpoint relationships with the outlet and inquire about its policies. Different types of outlets usually offer special deals that you, as a brand, can participate in. Information on competitors' promotions will help you understand which points of sale your competitors are betting on. This information can also help you identify what promotions are working for your competitors and what you can do to make your own promotions more effective.

Share of the shelf: This involves measuring the amount of shelf space your competitors are occupying in-store. This information can help you determine how much of the market your competitors are capturing and how you can improve your own share of the market.

On-shelf availability: This involves checking if your competitors' products are in stock and available for purchase. One survey found that 69% of customers will choose a substitute item after experiencing a first stockout, but after experiencing three of them, 70% of shoppers will go to another brand entirely. Knowing the on-shelf availability of your competitors can help you avoid their mistakes and win over new customers in the category.

Product placement (eye-level): This involves noting where your competitors' products are placed in-store and on shelves, particularly at eye-level. Visibility in stores noticeably affects customers' choices. Multiple studies have shown that the average customer doesn't think much before choosing one product or another and usually tends to buy what they can see right in front of them on the shelf. One of the main rules of merchandising is the eye-level is the buy-level.

Product assortment: This involves observing the variety of products your competitors offer in-store. This information can help you determine if there are gaps in your product offerings that need to be filled or if you need to modify your product line to better meet customer needs.

Promotions: This involves tracking any promotional activity your competitors are engaging in, such as sales, discounts, or bundle deals. It can also help pinpoint relationships with the outlet and inquire about its policies. Different types of outlets usually offer special deals that you, as a brand, can participate in. Information on competitors' promotions will help you understand which points of sale your competitors are betting on. This information can also help you identify what promotions are working for your competitors and what you can do to make your own promotions more effective.

Share of the shelf: This involves measuring the amount of shelf space your competitors are occupying in-store. This information can help you determine how much of the market your competitors are capturing and how you can improve your own share of the market.

On-shelf availability: This involves checking if your competitors' products are in stock and available for purchase. One survey found that 69% of customers will choose a substitute item after experiencing a first stockout, but after experiencing three of them, 70% of shoppers will go to another brand entirely. Knowing the on-shelf availability of your competitors can help you avoid their mistakes and win over new customers in the category.

Product placement (eye-level): This involves noting where your competitors' products are placed in-store and on shelves, particularly at eye-level. Visibility in stores noticeably affects customers' choices. Multiple studies have shown that the average customer doesn't think much before choosing one product or another and usually tends to buy what they can see right in front of them on the shelf. One of the main rules of merchandising is the eye-level is the buy-level.

How to collect in-store data

The main challenge with in-store data is its collection and storage. On average, CPG brands have up to 3,000 points of sale, and even the smallest ones are usually represented in more than a hundred outlets. So how can you organize data collection and make it real-time? That's where merchandising tools come in handy.

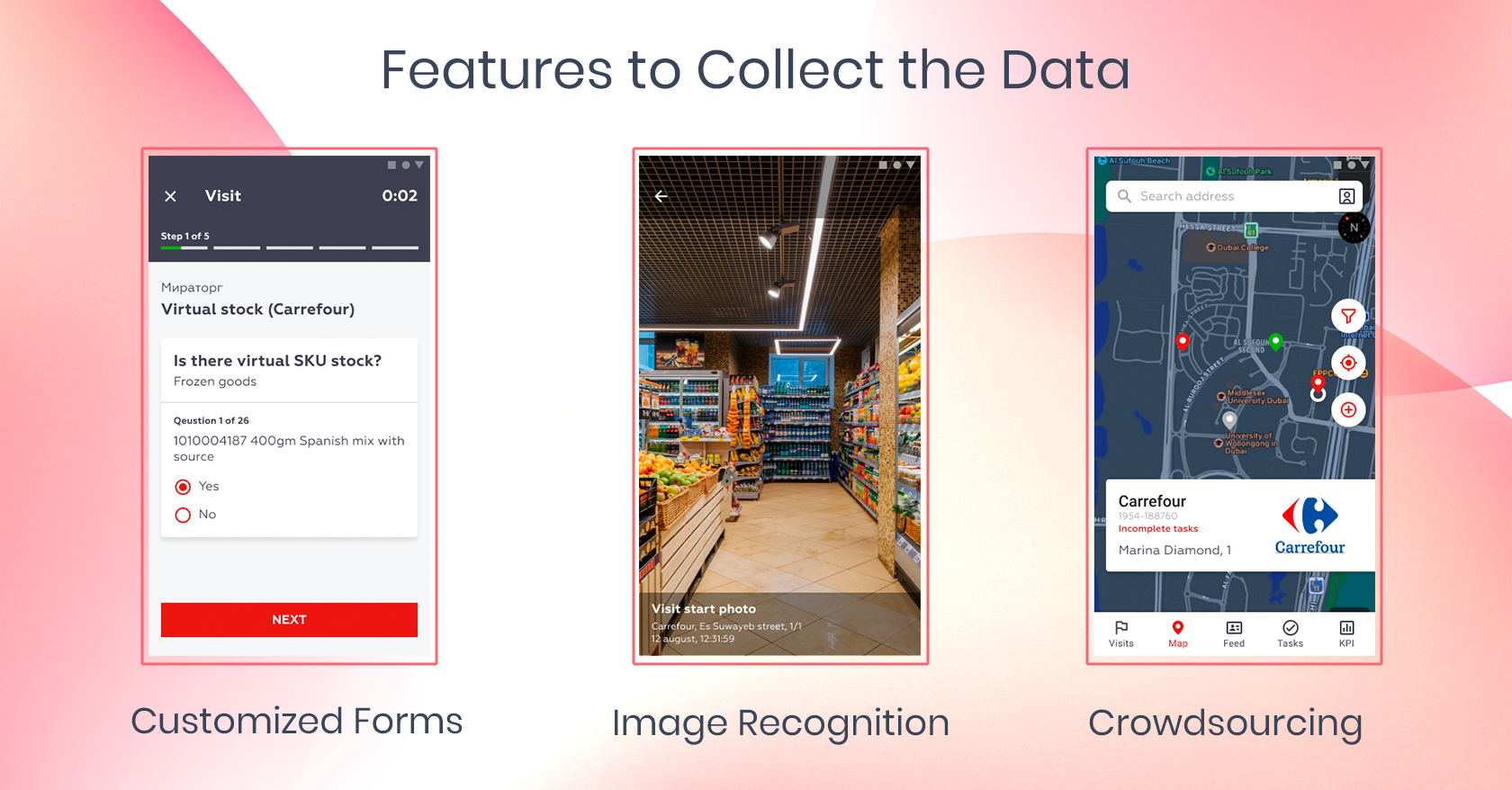

Field teams are equipped with a specialized app that helps them perform their day-to-day tasks during merchandising visits, such as checking the planogram and making adjustments. But the same tool can be used for competitors' audits. Here's how:

Field teams are equipped with a specialized app that helps them perform their day-to-day tasks during merchandising visits, such as checking the planogram and making adjustments. But the same tool can be used for competitors' audits. Here's how:

Customized forms

A brand or trade marketing manager can create a specialized form for merchandisers to collect the needed data. Adjustable settings allow for various types of data collection, such as numbers, checklists, or text descriptions. Key2Work app even allows for the addition of an algorithm for a field employee to follow, with detailed instructions about the next steps.

Image Recognition

Image Recognition is a powerful tool that is changing retail execution processes. It allows you to fill out forms in mere seconds – all that's required is to take a clear photo of the shelf. The accuracy of the data is up to 98%, and it helps to decrease human errors, making audits for competitor analysis much faster.

Crowdsourcing

Crowdsourcing platforms are popular among digital users and are now rising in the retail industry. Using the power of the crowd is, in some cases, more convenient and efficient than using a regular field team. Some audits can be performed by people in the area, and clients won't need to pay for travel time or other expenses. It allows you to get real-time data for your analysis from a particular point of sale at any given moment, which can be crucial in the fast-changing modern world.

A brand or trade marketing manager can create a specialized form for merchandisers to collect the needed data. Adjustable settings allow for various types of data collection, such as numbers, checklists, or text descriptions. Key2Work app even allows for the addition of an algorithm for a field employee to follow, with detailed instructions about the next steps.

Image Recognition

Image Recognition is a powerful tool that is changing retail execution processes. It allows you to fill out forms in mere seconds – all that's required is to take a clear photo of the shelf. The accuracy of the data is up to 98%, and it helps to decrease human errors, making audits for competitor analysis much faster.

Crowdsourcing

Crowdsourcing platforms are popular among digital users and are now rising in the retail industry. Using the power of the crowd is, in some cases, more convenient and efficient than using a regular field team. Some audits can be performed by people in the area, and clients won't need to pay for travel time or other expenses. It allows you to get real-time data for your analysis from a particular point of sale at any given moment, which can be crucial in the fast-changing modern world.

How to process in-store data

The amount of data collected in-store can be overwhelming and even useless if it is not properly organized and subjected to analysis. Brand managers and trade marketing specialists don't just need numbers; they need conclusions that will allow them to form and adjust strategies.

Automated in-app reports

Retail execution solutions can process all collected data by generating automated reports. Usually, there is a set of parameters that can be customized to get the necessary information. For example, in Key2Work, reports can be filtered by key metrics such as OSA, OOS, Share of the Shelf, Eye-level, pricing, and others, or by retail outlet type, time period, territory covered, brand, category, or specific SKUs.

BI dashboards

A more interactive and representative way to process and present collected data is with BI dashboards. They can be adjusted to reflect current numbers and updated in real-time in correspondence with the reports. Some retail execution solutions have an in-built BI dashboard feature, but most of them can also be integrated with other analytics systems used by your team. This allows for the data to show the bigger picture and fully utilize their potential.

Automated in-app reports

Retail execution solutions can process all collected data by generating automated reports. Usually, there is a set of parameters that can be customized to get the necessary information. For example, in Key2Work, reports can be filtered by key metrics such as OSA, OOS, Share of the Shelf, Eye-level, pricing, and others, or by retail outlet type, time period, territory covered, brand, category, or specific SKUs.

BI dashboards

A more interactive and representative way to process and present collected data is with BI dashboards. They can be adjusted to reflect current numbers and updated in real-time in correspondence with the reports. Some retail execution solutions have an in-built BI dashboard feature, but most of them can also be integrated with other analytics systems used by your team. This allows for the data to show the bigger picture and fully utilize their potential.

In conclusion, conducting a thorough and up-to-date competitive analysis is crucial for brands and retailers who want to succeed in today's market. By understanding the different types of competitors and gathering data both online and offline, businesses can gain valuable insights into their own products, strategy, and marketing efforts.

Ultimately, a comprehensive competitive analysis can be the difference between a business that thrives and one that fails to keep up with the competition.

Ultimately, a comprehensive competitive analysis can be the difference between a business that thrives and one that fails to keep up with the competition.

Do you want to better know your competitors and market?

Book a demo with us!

Book a demo with us!

Let it start...